The small family run business with less than 5 Staff/ contractors

We complete all of your compliance requirements from as little as $38/week

We have been helping businesses in every industry for over 20yrs. Building a professional reputation based on quality service, integrity and loyalty is what our business is built on.

We are registered BAS Agents and have all the qualifications and knowledge needed to ensure you stay informed and compliant at all times.

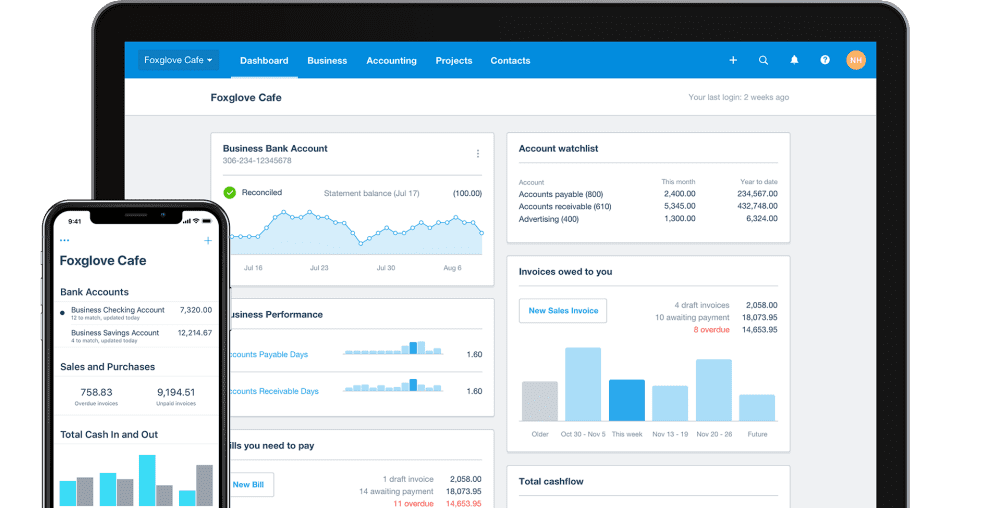

We have developed the most advanced and efficient systems for maintaining your ATO requirements using cloud technology in realtime.

Everest Business Solutions offers a broad range of skills, servicing many different industries. We unravel the most complicated ATO compliance requirements and deliver it in convenient packages to suit your business.

We specialise in tradies, sole traders and small businesses. We are passionate about providing quality packages at an affordable price.

The Everest Business Solutions specialises in small businesses and tradies. We provide you with all the tools and support to ensure your business is professional and set up for success. Our consultants are your first point of contact and are available to answer any questions you may have.

Everest has years of experience resulting in the creation of the ideal system that is efficient and compliant with all regulatory requirements. This system will give you peace of mind and free up your time to do what you do best.

Everest helps you choose the correct software for your business with implementation and proven systems the key to success.

Our team of consultants are incredibly accurate and detailed with all work they complete. This means critical information will always be at your fingertips.

Everest provides direct personal support critical for your business success. Our consultants are your first point of contact.